What’s happening with luxury multi-brand online retail strategies? It’s no secret that these platforms are facing what the Financial Times has dubbed ‘the implosion in luxury e-commerce’ (March 2024).

View this post on Instagram

In early December 2023, Farfetch, the British online retailer, sought a cash injection to avoid collapse. By mid-December, they found their ‘White Knight’ in the form of South Korean e-commerce giant Coupang, often referred to as the ‘Amazon of Asia’ as it operates food delivery, video streaming and payment services in markets including South Korea, Taiwan, Singapore, China and India. This move saved Farfetch from potential bankruptcy but marked a significant downfall for a company once valued at $24.9bn. Founder José Neves has since departed the company he founded in 2007.

Visualizza questo post su Instagram

In March 2024, just two months after acquiring luxury online retailer Matches for £52 million, Frasers Group announced that the e-tailer would enter administration due to continual failure to meet business plan targets and significant losses.

Visualizza questo post su Instagram

Additionally, Richemont, the parent company of Yoox Net-a-Porter, has been seeking a new buyer for the business since a deal to sell a 47.5 percent stake to rival e-commerce retailer Farfetch collapsed at the end of the previous year. In essence, Richemont is still attempting to offload its loss-making e-commerce business Yoox-Net-a-Porter.

In today’s turbulent market, MyTheresa, the Germany-based luxury online retailer listed in New York, stands out as one of the few retailers in good financial health. Just a few days ago, they announced preliminary third-quarter results showing double-digit topline growth and significantly improved profitability. Rumours also suggest they are among potential bidders to acquire the loss-making e-commerce business Yoox Net-a-Porter from Richemont. However, aside from MyTheresa, the landscape outlined above underscores significant instability in the high-end e-commerce platforms.

In the wake of the pandemic's digital wave, the thirst for physical connections is blooming anew. Collage courtesy of IM alumna and graphic designer Constanza Coscia

What’s causing this upheaval? One reason is the fading allure of online shopping post-Covid. On the one hand, there’s a growing yearning among consumers for an abundance of face-to-face experiences, recognising human interaction as vital, not only in daily life but also in the shopping sphere. On the other hand, physical retailers, including major multi-brand department stores, are actively strategising to lure customers back to their brick-and-mortar boutiques.

Brands are embracing the pivotal role of in-person shopping and personalised staff interactions in fostering lasting connections with customers. Collage courtesy of Constanza Coscia

Similarly, individual brands are pursuing the same goal, firmly believing that the in-person shopping experience and personalised interactions with staff are essential for cultivating strong customer relationships. To achieve this, they are investing more than ever in creating immersive experiences, harnessing technologies like virtual reality, and organising special events to enrich the shopping journey and make a lasting impression. Moreover, they are enhancing their repair services, embracing the growing trend of the second-hand market, and placing a greater emphasis on sustainability, which is becoming increasingly important to communities.

The crisis for fashion e-tailers is compounded by logistical challenges in e-commerce, including complex international shipping and high return costs. Collage courtesy of Constanza Coscia

Contributing to the crisis of fashion e-tailers are logistical challenges inherent in e-commerce, including complex international shipping processes and high return costs. Additionally, the cost of online business has been rising due to the constant need for technological updates and investments, which has further aggravated the situation.

The pandemic prompted high-end fashion brands to invest more in their e-commerce and distribution capabilities after realising their lack of online presence control. Collage courtesy of Constanza Coscia

These challenges are compounded by the rise of direct-to-consumer (DTC) online models, which put pressure on multi-brand platforms by allowing luxury brands to sell directly to consumers. Historically, luxury online retailers benefited from luxury brands being slow to embrace selling online. However, the COVID-19 pandemic served as a wake-up call for high-end fashion brands, prompting them to realise that they lacked control over their brands’ online presence. Consequently, they began investing more in their own e-commerce and distribution capabilities, thereby reducing wholesale distribution and assuming greater control over their online sales channels.

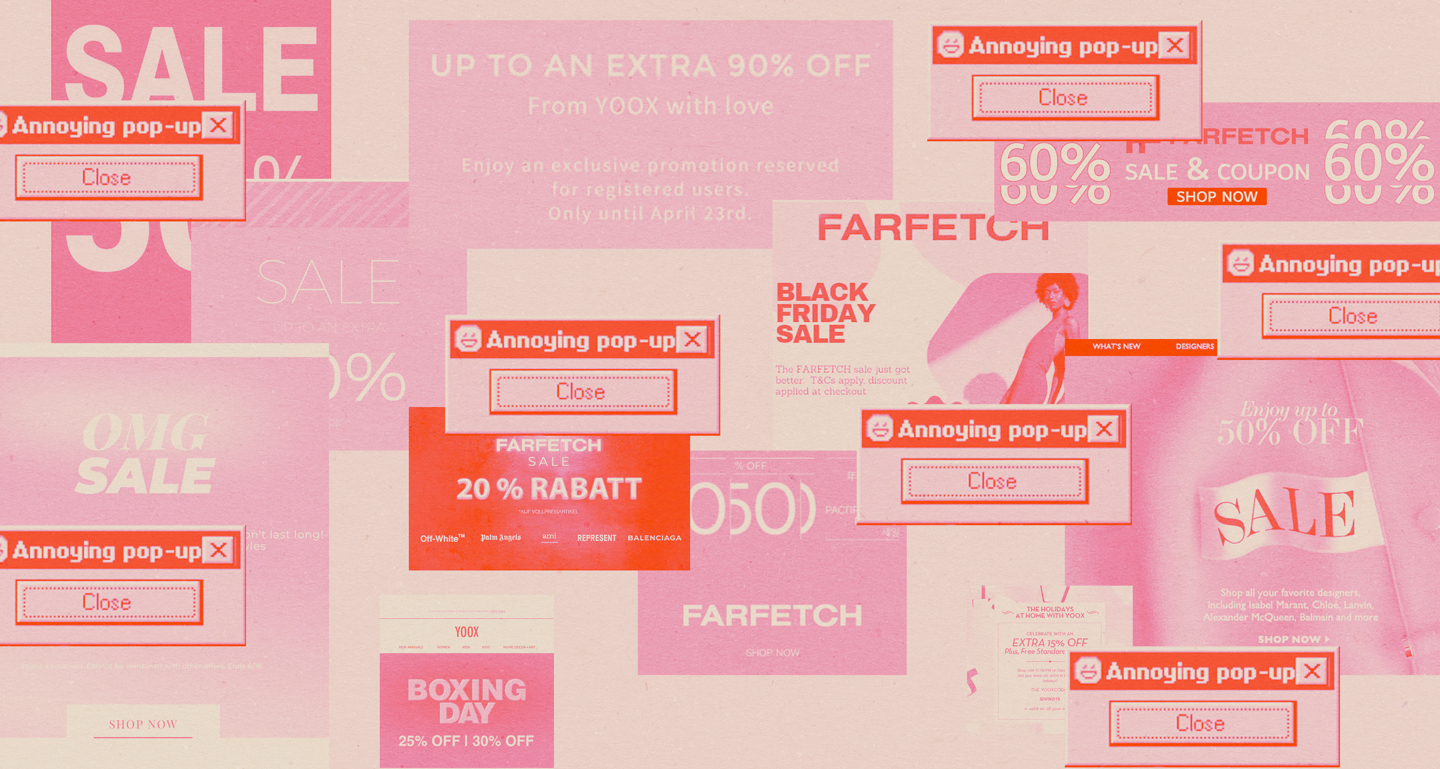

As highlighted by the Financial Times, this situation also underscores a fundamental conflict between the business models of multi-brand platforms and the luxury industry. While (online) retail platforms typically operate on narrow profit margins and frequently resort to discounting, luxury brands prioritise maintaining high margins and tightly control pricing and marketing strategies. In essence, multi-brand retailers often attract customers through promotions, which can strain relationships with luxury brands that seek to preserve their image of exclusivity and avoid discount sales. Additionally, luxury brands often reserve their best-selling products for their own channels, leaving multi-brand retailers with less desirable inventory.

Consumers feel overwhelmed by options, and multi-brand online retailers worsen the issue. Collage courtesy of Constanza Coscia

It’s also worth considering that today’s consumers already feel overwhelmed by the abundance of options available, and multi-brand (online) retailers often make the problem worse.

This series of issues is further compounded by the fiercely competitive landscape of major multi-brand (online) retailers, where everyone is offering products that are increasingly similar, if not identical. This creates a persistent challenge as companies compete for customers’ attention, often lacking uniqueness and distinction in their offerings. This trend is driven by their overreliance on ‘big name’ brands, which dominate their product assortments, leaving little space for distinctive selections from emerging or lesser-known labels. In this scenario, a strategic approach would be to prioritise smaller designers and give them the same importance as established brands rather than attempting to cater to everyone’s preferences. “Multi-brand stores have to stand for something; they have to have a unique point of view. There’s no point in just selling the same old stuff as all the other brands,” said Mathew Dixon, Partner in the Consumer & Retail Practice Group at DHR Global. According to Dixon, successful retailers need to differentiate themselves through curated product selections.

Last but not least, there has been a sector-wide slowdown in luxury following the post-pandemic boom. This highlights that luxury consumption is slowing down, as even wealthy consumers are hesitant to spend due to concerns such as inflation and rising interest rates.

While the future of multi-brand luxury online retailers is uncertain, some experts believe there's a glimmer of hope for recovery. Collage courtesy of Constanza Coscia

As underscored by the Financial Times, both investors and luxury clientele are left speculating about the fate of digital retailers—whether any will manage to weather the storm, that is. According to industry insiders and analysts, those eschewing heavy discounting and opting instead for a more personalised, curated approach targeting the upper echelon of affluent consumers, à la the anticipated German luxury e-tailer Mytheresa, appear to have the greatest likelihood of survival.

In a statement to the Financial Times, Claudia D’Arpizio from Bain & Company noted that customers still value multi-brand shopping environments, citing the monotony of mono-brand experiences and the inability to mix and match purchases with other labels. “The challenge now,” D’Arpizio concluded, “is finding a formula that can work for both brands and online retailers.” So, there remains a glimmer of hope for recovery.

Lihi Gindi Levy

Student of the BA in Fashion Business & Buying, London