What is China’s luxury shame that prompts fashion brands to slash prices?

Luxury brands in China are heavily discounting their high-end items, driven by excess inventory resulting from reduced local consumer spending

Unprecedented discounts are sweeping through high-end fashion as luxury has kicked off the season of big discounts in China.

According to Bloomberg, many luxury brands are marking down their products to levels not seen in years, citing growing concerns about unsold inventory and reduced consumer spending.

Starting this month, Chinese shoppers can snag Balenciaga’s iconic Hourglass handbag in the smaller crocodile-print style with a 35% discount on Tmall, Alibaba’s B2C platform—a discount that’s much higher than what is available on the brand’s official websites and major luxury e-tailers.

Kering’s fashion house has led the charge, with an average price reduction of 40% on sale items during three of the first four months of 2024, per sources close to the company.

The number of discounted products on Tmall has more than doubled, making up over 10% of the platform’s inventory from January to April. This is a stark contrast to the previous year when price cuts were limited to January and averaged around 30%.

High-end brands in China are significantly reducing prices on their luxury goods due to surplus stock caused by a decline in local consumer spending. Artwork courtesy of IM alumna and graphic designer Constanza Coscia

Other fashion houses are following suit. Versace, part of Capri Holdings (recently acquired by Coach owner Tapestry), LVMH-owned Givenchy, and Burberry have slashed prices—some by more than half—on Tmall and other domestic platforms this month.

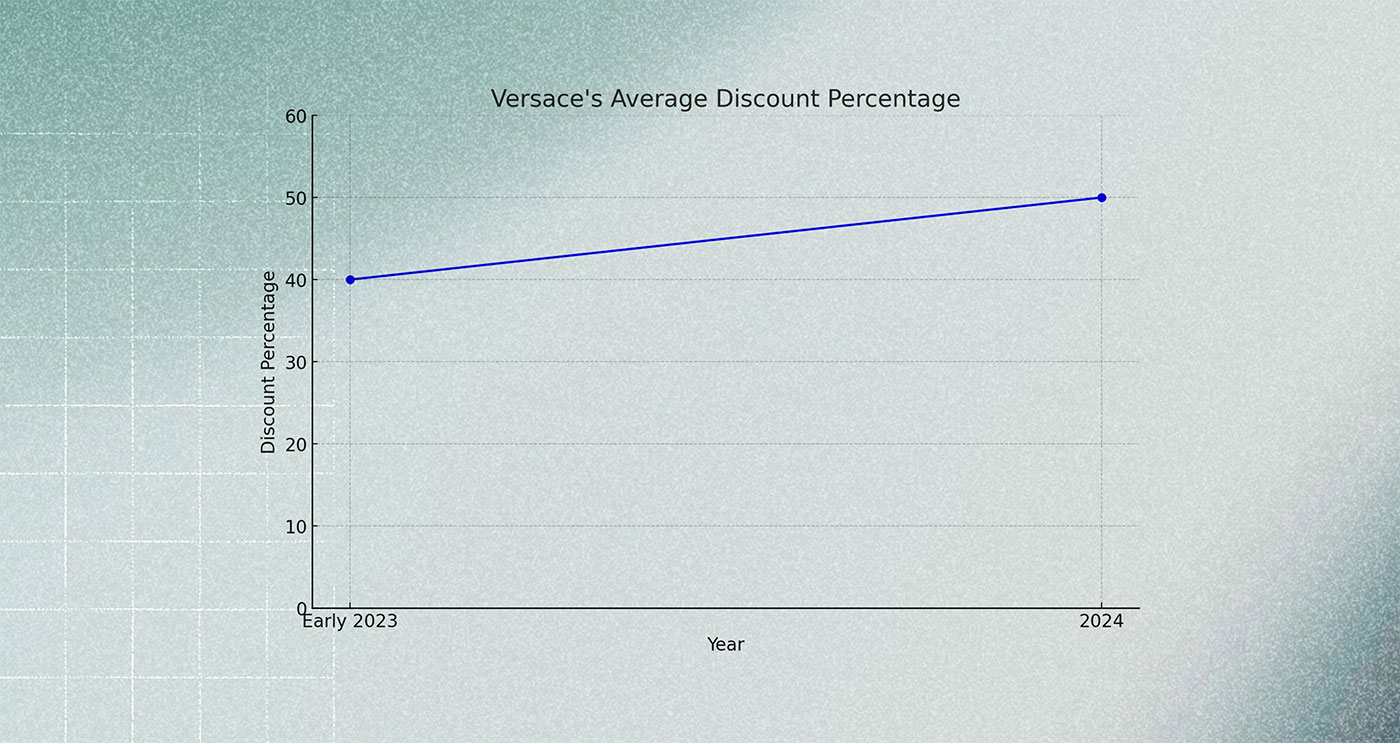

Versace’s average discount jumped from about 40% in early 2023 to over 50% this year.

Such aggressive price cuts were unimaginable a few years ago when maintaining high prices was crucial for brand exclusivity.

Luxury brands typically avoided direct sales or discounts on flagship platforms, opting instead for department stores or private sales. Jacques Roizen, CEO of Chinese consultancy Digital Luxury Group, told Bloomberg that the choice of Tmall, a well-known consumer platform, for staging these discounts is particularly surprising. So far, none of the brands involved have commented on this strategy.

Versace’s average discount jumped from about 40% in early 2023 to over 50% this year. Artwork courtesy of Constanza Coscia

This shift underscores the challenging situation faced by global fashion houses in China, as they struggle with an economic slowdown that’s reducing consumers’ purchasing power, especially within the middle class.

The high return rates on Tmall, driven by promotional campaigns, add to the complexity.

Yoox Net-a-porter, a luxury and fashion e-tailer still owned by Richemont (though the Swiss group aims to sell it), recently withdrew from the Chinese market. This highlights the challenges faced by high-end retailers in a weakening economic environment, prompting a strategic focus on more profitable regions.

Meanwhile, top luxury brands like Louis Vuitton, Chanel, and Hermès are not following the discount trend; instead, they are choosing to raise prices to combat the resale market and protect their exclusivity. These brands, alongside Gucci, Prada, and Miu Miu, have limited or no presence in online retail to focus on their high-spending customers.

However, the overall downshift in China’s market is undeniable, as highlighted by a recent Altagamma and Bain & Company study. The study indicates that the Chinese market is under significant pressure from recovering international tourism and declining domestic demand due to economic uncertainties. This has led to “luxury shame” among middle-class consumers, echoing the 2008 financial crisis in the Americas.

While offering discounts may help clear unsold stock in the short term, it also poses the risk of eroding the desirability that underpins luxury brands’ identities and businesses.

Angelo Ruggeri

Journalist, Master’s Programme Tutor & Fashion Styling Course Leader, Milan