The Billion-Dollar Mistake: Is Fashion Ignoring Its Very Important Customers?

“Beyond Money” clients represent less than 1% of consumers but account for 20% of spending. Never heard of them? You’re not alone – brands are often unaware of them, too

How can the luxury sector navigate its current challenges? Which consumer segments offer the greatest opportunities? Where can these consumers be found, and how can they be engaged? These are the pressing questions confronting both established and emerging players in the fashion industry as they formulate strategies for a more resilient future.

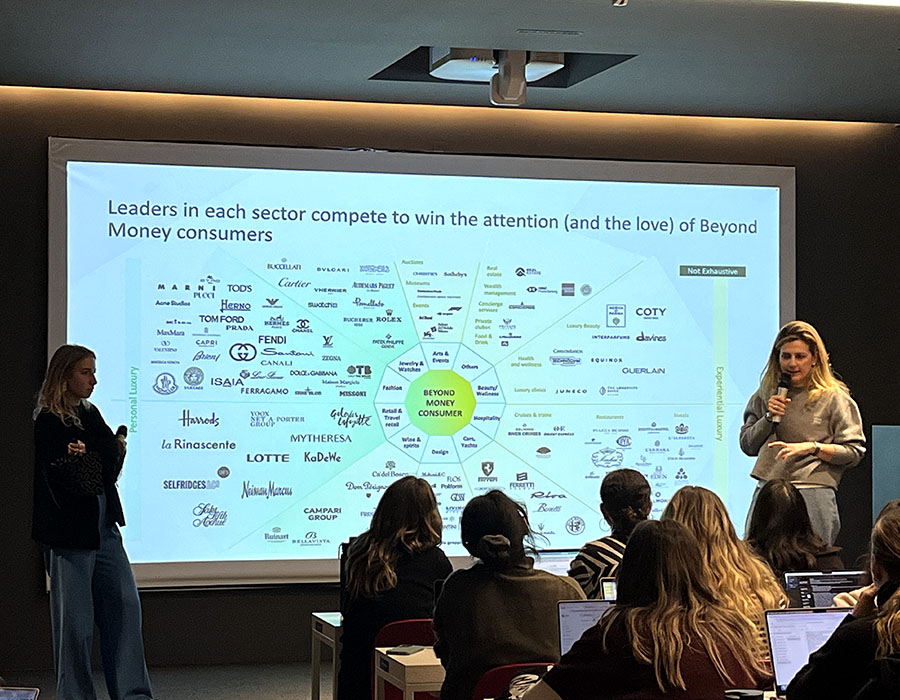

Amid this complex landscape, some clarity is emerging. The True-Luxury Global Consumer Insight, a study by Boston Consulting Group unveiled at the tenth edition of the Altagamma Consumer and Retail Insight event, provides a data-driven examination of the behaviours and expectations of high-net-worth luxury consumers. The report highlights the shifting dynamics within the sector, identifies the key consumer segments driving growth, and offers a strategic blueprint for brands seeking to remain competitive in a volatile market.

Presented at Istituto Marangoni Milano, the report examines a particularly influential segment within the market: the “Beyond Money” consumers. Despite making up less than 1% of the global luxury customer base, this group is responsible for over 20% of the sector’s total spending, underscoring their disproportionately large economic impact.

“Beyond Money” consumers are redefining traditional notions of luxury consumption and are transforming how high-end brands interact with their most valued clients. Their spending patterns remain largely unaffected by economic cycles or geopolitical instability, making them a reliable source of revenue.

The study also identifies critical shortcomings in how fashion brands engage with this segment. Inadequate target segmentation and a lack of sufficiently customised experiences are preventing many companies from fully capitalising on the spending potential of Beyond Money consumers. To maintain relevance, the report argues, brands must enhance their client targeting tools and invest in technology to analyse customer behaviours. Moreover, they should move beyond product excellence to provide deeply personalised service and foster a sense of belonging within an exclusive community.

This analysis points to a broader shift in the luxury industry, where the focus is moving away from aspirational buyers towards the highest-spending clientele, whose expectations and preferences are reshaping the market at a structural level. Below are the key takeaways.

The True-Luxury Global Consumer Insight (a study by Boston Consulting Group) was presented at Istituto Marangoni students with a focus on the Beyond Money consumers.

Who Are the ‘Beyond Money’ Consumers?

In the luxury sector, a small but highly influential segment is shaping global spending: the Beyond Money consumers. Although they account for less than 1% of the total clientele, they contribute to over 20% of luxury sales, highlighting their significant impact on the market.

So, who are these consumers? They are more than just wealthy individuals; they seek something beyond mere ownership. For them, luxury is about identity, values, and creating meaningful experiences. They demand authenticity, exclusivity, and deeply personalised relationships with brands, rather than just possessing high-end goods.

Despite this, according to the True-Luxury Global Consumer Insights 2024 report by Boston Consulting Group, 7 out of 10 luxury brands where Beyond Money consumers shop still fail to recognise these individuals as their most valuable clients. This oversight risks missing key opportunities in an increasingly competitive market.

Luxury and Myopia: Why Are Brands Overlooking the Highest-Spending Consumers?

Failing to identify Very Important Consumers (VICs) is not just a misstep—it is a systemic flaw in many luxury brand strategies. Too often, brands continue to rely on outdated segmentation models based on basic metrics such as purchase volume or geographic location.

As a result, 70% of opportunities are missed—opportunities that could be captured through more refined, data-driven segmentation.

Key findings from the report include:

- 89% of VICs value luxury goods for their craftsmanship and quality.

- 83% find bespoke products more fulfilling than standard luxury items.

- 85% cite exclusivity and recognition among peers as major factors in their preference for luxury goods.

- VICs are increasingly disengaged from traditional boutique experiences; they are seeking highly personalised services instead.

The True-Luxury Global Consumer Insight (a study by Boston Consulting Group) was presented at Istituto Marangoni students with a focus on the Beyond Money consumers.

Regional Challenges

On a global scale, the luxury industry faces distinct challenges depending on region.

In the West, the growing sophistication of VICs is prompting brands to move beyond traditional retail experiences, with clients demanding more comprehensive and tailored engagements.

In the East, however, brands often struggle with a lack of global recognition of VICs, as well as cultural misunderstandings that hinder their ability to capitalise on this lucrative group.

The Future of Luxury: Bridging Technology and Human Connection

How can brands address these challenges? The solution lies in harnessing technology while maintaining a vital human touch. Artificial intelligence and big data now make it possible to analyse VIC behaviours and preferences with unprecedented accuracy, enabling brands to anticipate their needs and desires.

The future of luxury will see brands offering not just products but also crafting unique and timely experiences—whether through exclusive invitations, bespoke items, or personalised services. Luxury will be defined less by the physical object and more by an ongoing, meaningful relationship between the brand and the consumer.

However, technology should not replace the human element. VICs value empathy, personal connection, and meticulous attention to detail—qualities that no algorithm can replicate. Brands that successfully combine technological innovation with human engagement will be well-positioned to lead in an increasingly competitive landscape.

A Call to Action for the Luxury Sector

The Beyond Money segment is not a distant future; it is the present. Ignoring this group risks losing market share and missing out on significant profit opportunities. With global luxury spending expected to grow at 10% annually, according to the report, the time for brands to invest in smarter segmentation and hyper-personalisation is now.

VICs are not waiting: which brand will win their loyalty?

Agnese Pasquinelli

Alumna, Milano